by Dave DeMars

news@thenewsleaders.com

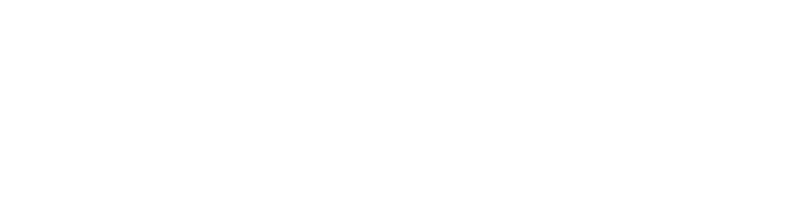

The St. Joseph City Council held a special-assessment hearing as part of its regular June 5 meeting to consider and adopt proposed assessments for the improvement of alleys between Minnesota Street and Birch Street (Block 12 project) and College Avenue N. and First Avenue NW (Block 9 project). In the public comments portion of the hearing, the council met with strong opposition from property owner Mike Deutz.

St. Joseph City Engineer Randy Sabart took the council through a review of the planning and implementation process with a presentation explaining what had been done up to this time, the costs involved and what actions still needed to be taken.

Sabart explained there had been considerable cost savings on the projects when compared to the original estimate. Final costs for the Block 9 project were reduced by nearly $63,000 and Block 12 was reduced by $58,513. The proposed assessment for the projects is $361,200. Sabart explained property owners had several options for paying for the assessments, including installments over a 10-year period at a 6-percent interest rate.

Sabart also explained how the assessment costs were reached, but that is where property owner Mike Deutz took issue. According to Sabart, the city hired an outside special assessor to determine what the special benefits to each property owner might be. Homestead properties are treated differently than commercial properties, and there are special deferrals for individuals with disabilities, armed-forces personnel and senior citizens.

“In the case of commercial industrial areas, the (city) policy states they may assess up to 100 percent to the property owners for sub-surface improvements,” Sabart said.

The benefits derived from the improvements included alley paving, storm drains and sanitary-sewer lining improvements, Sabart explained. While the city could assess up to 100 percent of costs to the property owners, in this case the city derives some benefit from the improvements and would subsidize nearly $126,000 of the $198,808 cost for Block 9 and $84,600 of the $162,387 cost for Block 12.

When Sabart finished his presentation, Deutz took the podium and addressed the council. His first concern was why property owners were asked to pay interest on projects before they were completed or paid for. Sabart explained the process had to do with savings on capitalized interest. Ultimately, because of the way in which bonds are written, the city and property owners would actually pay more if they waited to collect costs at the end of the building project rather than on a bond-interest payment during the course of the building project.

“If they issued the bond and did not let assessments until next year, you would have had at least one year of capitalized interest on the bond,” Sabart said. “So when we ultimately sell the bonds there would be an interest expense (in which) they are not collecting revenue to retire the debt. So one option is to levy the assessments at this point before the project starts to save on capitalized interest.”

Deutz seemed satisfied with that explanation and moved on to his second question which had to do with how the benefit analysis on the properties had been done.

“How was the cost benefit figured?” he asked.

St. Joseph City Attorney Tom Jovanovich tried to explain, saying the assessor looked at Block 9 and then at Block 12 to determine benefit. He did not look at each individual property but rather how the block as a whole would benefit from the improvement.

“He looks at all the properties, and then he says on this particular lot, these properties will generally receive a benefit of so much,” Jovanovich said. “And then he broke that down between clearly commercial property and existing residential property.”

Deutz asked if it were possible to obtain a copy of the appraised-value report so he could see what each parcel was appraised.

“He doesn’t appraise each parcel,” Jovanovich said. “This is not an appraisal. He calls it a benefit analysis. An appraisal is much more detailed. I have it right here if you want to look at it.”

“By your definition – by council’s definition or city ordinance – I’ve got a lot at 835 W. Minnesota St. and its not buildable,” Deutz said. “And you have assessments on that piece of property, and that piece of property is used specifically for parking for the general downtown business district. I want to see what it’s cost benefit is because I can’t build on it.”

Jovanovich asked what prevented Deutz from building on the property and was told it would not meet code requirements for setback and parking. Basically, the lot is too small because it’s only half a lot.

“There is nothing I can do with the lot,” Deutz said. “How can you tell me there is a benefit of this to me? I’ve already paved the lot.”

“It’s still a benefit because it’s commercial property,” Jovanovich said.

“What are you going to do with it?” Deutz said. “It’s a paved parking lot. You can’t improve that value.”

Jovanovich said Deutz’s use of the lot for his business was a benefit, but Deutz shot back that everybody downtown uses that lot, so really he doesn’t get any benefit from it.

“Who owns it?” Jovanovich asked.

“I do,” Deutz said.

“So use it any way you see fit,” Jovanovich said.

“OK, then I’ll just block it off,” Deutz replied.

“That’s your choice,” Jovanovich replied.

“I don’t want to be like that,” Deutz said. “But there is no benefit to any of this sewer line or any of the storm water to that lot.”

Jovanovich and Deutz continued their verbal sparring with Deutz saying ultimately the improvements were of little benefit to him and he should have received a copy of the benefit analysis well before the night’s meeting. Jovanovich suggested Deutz add on to an existing building to gain use from the lot.

St. Joseph Mayor Rick Schultz closed the hearing and the council took up the question. Schultz was understanding of Deutz’s argument as was council member Bob Loso. For his part, Loso said he did not like the way in which the benefit analysis was done.

Jovanovich explained the assessor was adamant in doing the cost benefit in the manner he had because commercial lots were receiving a greater benefit than were residential homeowners.

“He’s the expert here, and he didn’t want to change it,” Jovanovich said.

“I believe the city should pay for more because this benefits the downtown business district which is the crowning glory of St. Jo(seph),” Loso said.

Council member Dale Wick inquired whether there were many more small lots similar to Deutz’s that are unbuildable. He was assured there are quite a few, and most of them are in the downtown section of town, which is where St. Joseph first took root.

There was a brief consideration of delaying the project, but in the end Wick made the motion to approve resolution 2017-20, which is to levy assessments for property owners with the modification that interest charged on installments would be 2 percent above the actual bond issue. The motion was carried 4-1 with Loso casting the lone no vote.

Wick then moved to adopt resolution 2017-21, awarding the contract for the alley improvements to C&L Excavating. The motion was carried unanimously, and the council immediately adjourned.

Mike Deutz, a St. Joseph property owner, listens attentively to an explanation of how the assessment process works at the June 5 St. Joseph City Council meeting. A portion of the meeting was dedicated to a special hearing to decide on how to assess for work being done on alleys in the city. Deutz contends since his property was unbuildable, he receives little if any benefit from the alley improvements.

St. Joseph City Engineer Randy Sabart explains how bonding works when that format is used to fund city building projects at the June 5 St. Joseph City Council meeting.

St. Joseph City Attorney Tom Jovanovich tries to explain the concept of benefit assessments at the June 5 St. Joseph City Council meeting. Benefit assessment means property owners derive a benefit from improvements made to adjacent roads and streets that border their property. Payment for the improvements is based on how much benefit a property owner might derive from the improvements. Commercial properties are thought to derive the most benefit from improvements.

The crosses indicate the alleyways that will receive improvements over the summer. Improvements should be finished by October. Payment for improvements was a major topic of discussion during the special-assessment hearing at the June 5 St. Joseph City Council meeting.